- Bill Gates has amassed an extensive — and high value — real estate portfolio.

- His many houses come with a multi-million dollar tax bill each year.

- Here's how much Gates paid in property taxes last year.

As the old saying goes, nothing can be said to be certain except death and taxes.

And even though the very wealthy have been criticized for not paying their fair share, there's one area where it's pretty hard to avoid the taxman: property.

Every year, billionaires must take out their checkbooks and send off thousands to their local governments. While the amount they pay is typically pennies compared to their overall net worth, some billionaires who have amassed large real estate portfolios pay tax sums that would make the jaws of mere mortals drop.

Bill Gates is one of them. Last year, the homes owned by Gates and his former wife, Melinda French Gates, racked up a $2.7 million property tax bill last year. That's more than 700 times as much as the average American pays in property taxes each year.

The former richest man in the world, Gates has amassed 275,000 acres of land, making him the country's 42nd biggest landowner, according to the Land Report. While most of that is farmland and tied to investments, 245 acres are for personal use.

He and French Gates spent more than $150 million over three decades buying up their current real estate portfolio. Following their 2021 divorce, a number of the properties were transferred from one trust to another. It's nearly impossible to discern who owns what, as all their trusts are linked to the same Seattle bank.

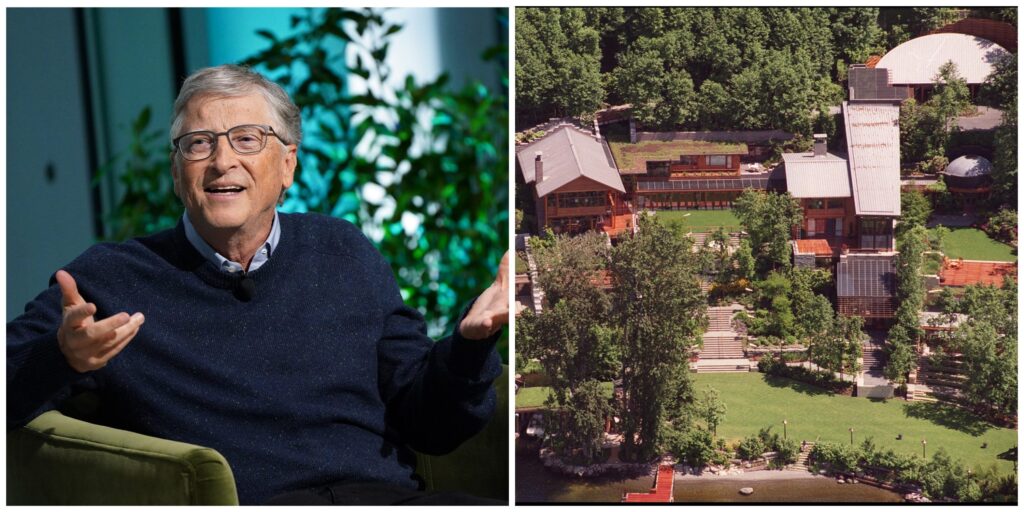

Gates' highest property tax bill is in Washington state, where he has a 10.5-acre property in the tony Seattle suburb of Medina along Lake Washington. He spent $34 million buying the 12 parcels of and around his mansion, known as Xanadu 2.0, and together, they have an assessed value of $183.5 million. Last year, the property taxes on the properties added up to $1.3 million. The taxes on the largest of the parcels — 5.15 acres on the water — will exceed $1 million this year.

Gates owns five properties in California, where property values are known to be high. Taxes are highest on the Del Mar beach house he purchased in 2020. The home, which cost $43 million and set a record at the time, came with a tax bill of about $480,000 last year.

In Florida, where Gates owns an equestrian compound in Wellington, he paid $280,000 in taxes last year, and in Montana, where he has a house in the exclusive Yellowstone Club, he paid $107,000.

While high by most standards, Gates' property tax bill represents less than 0.01% of his $148 billion net worth — and a fraction of his total tax bill.

While Gates pays a higher effective tax rate on his wealth growth than other billionaires, he has a lower effective tax rate on his income than most other billionaires and high-earning Americans. In 2022, ProPublica reported his annual average income from 2013 to 2018 was $2.85 billion, and his annual federal income tax rate was 18.4% — meaning he would have paid about $525 million in federal income tax each year, according to BI calculations.

He's not one to complain, though. Gates has said that the ultrawealthy should pay more in taxes.

"In terms of the very rich, I think they should pay a lot more in taxes, and they should give away their wealth over time," he said during a Reddit "Ask Me Anything" last year.